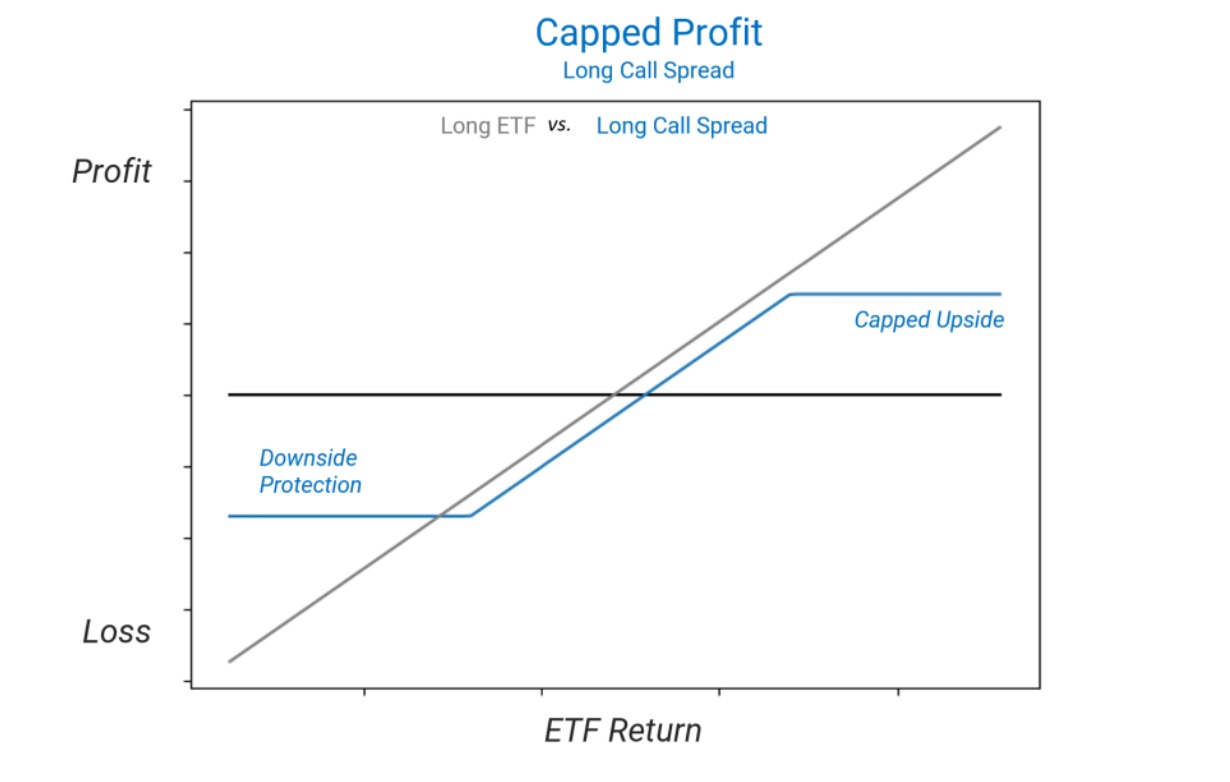

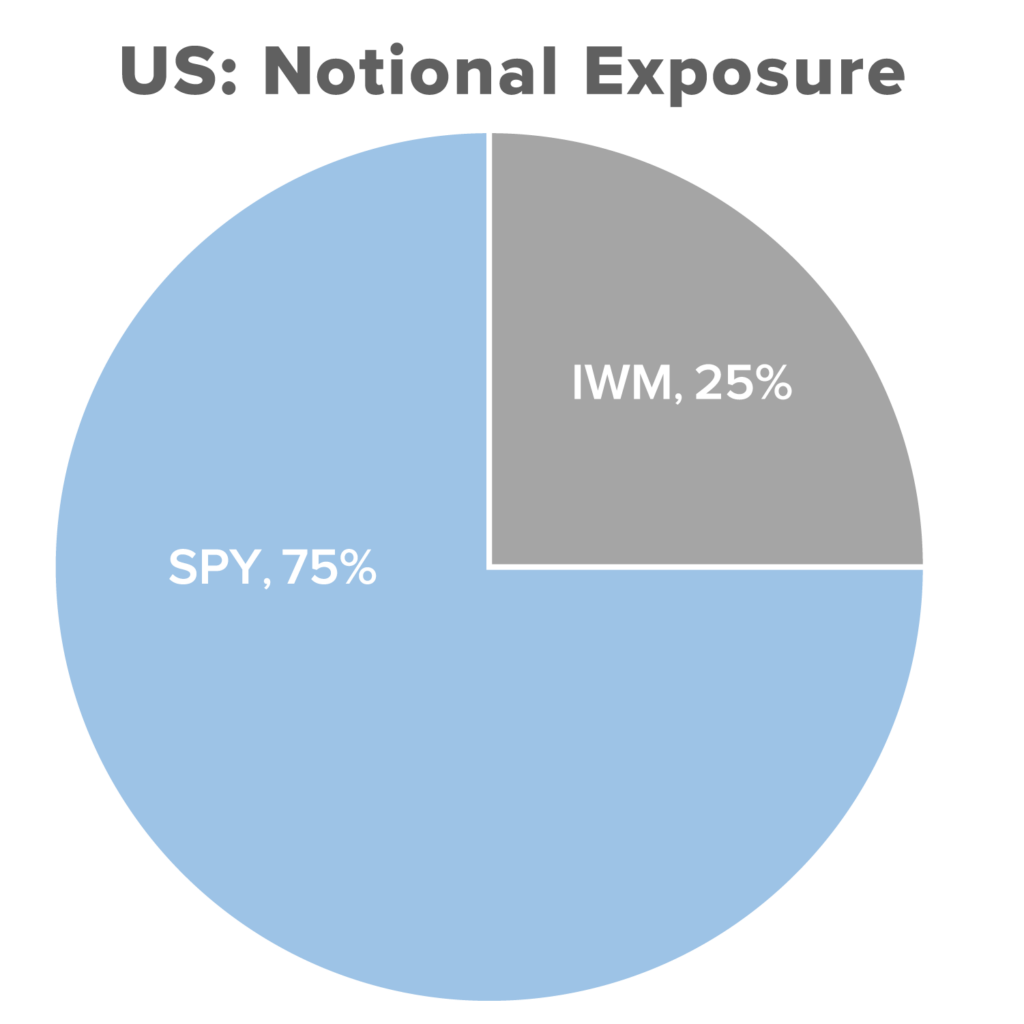

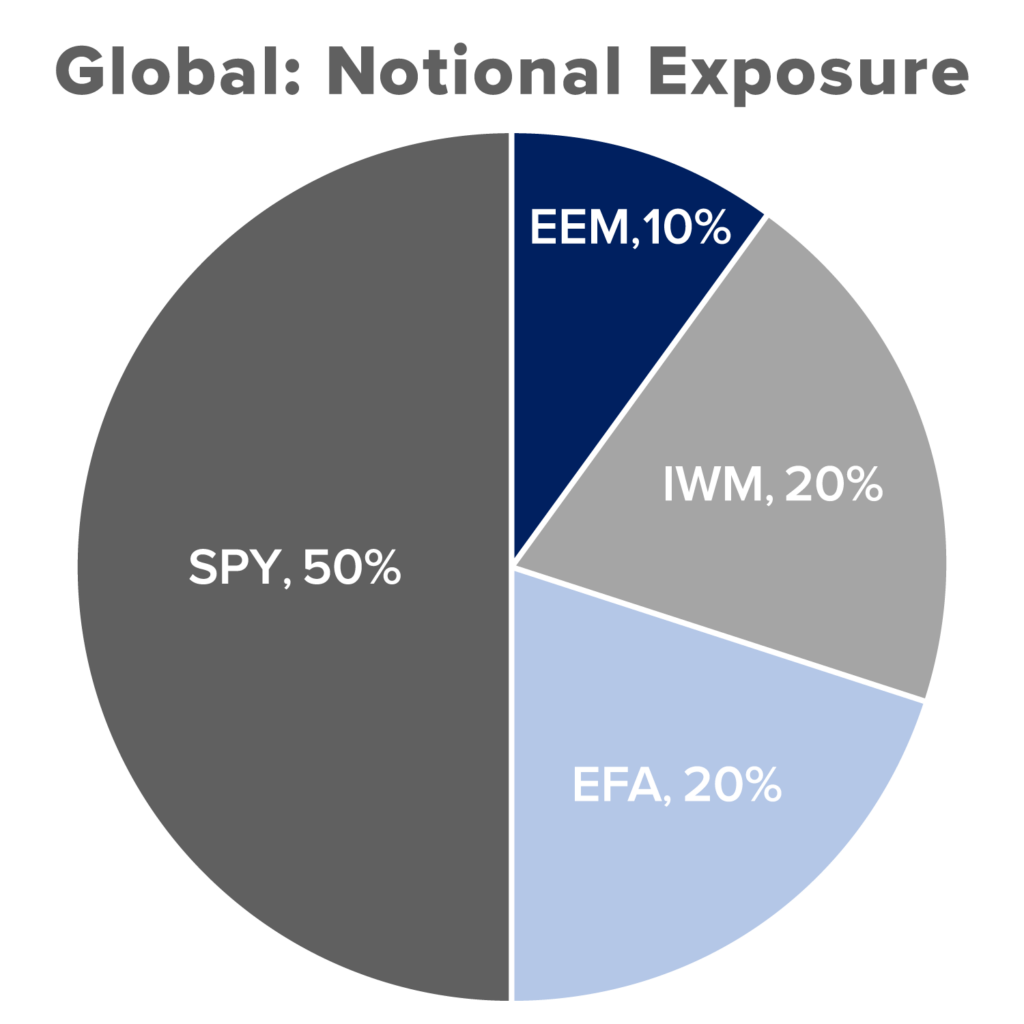

The TOPS® US Equity Target Range Index and the TOPS® Global Equity Target Range Index track the performance of a systematic collateralized conditional call / call spread strategy. At any point in time, the strategy has a long call option, and possibly a short call option, for each of either two or four ETFs and a Collateral Account that accrues interest at the theoretical Treasury Bill rate on a daily basis. The call options are January expiring options that each close out in January, three days prior to expiry, and a newly selected call option(s) for each ETF are notionally sold on the same day, a process known as “rolling”. Each January the call options are selected such that they have a target expiration of the third Friday of January the following year, and for each ETF, the long call option will have a strike price that is near 15% in-the-money and the short call option, will have a strike price near 15% out-of-the-money. The call options are sized based on predetermined weights. Additionally, at the start of each noted month the call options for each ETF may be restriked if the price of that ETF has increased by a specified level.

Portfolio Construction & Rules

- Long Call Spreads

- 12-Month Maturities

- 15% In-the-Money Long Call

- 15% Out-of-the-Money Short Call

- Monthly restrike opportunity

- Rolled prior to maturity.